Is it worthwhile to use Robinhood for your investments instead of one of the many other investing apps out there? At HowTheMarketWorks, we provide our members with unbiased reviews of investing apps and tools. We do that by using the tools in question to make sure you’re getting the full picture before you try them Read More…

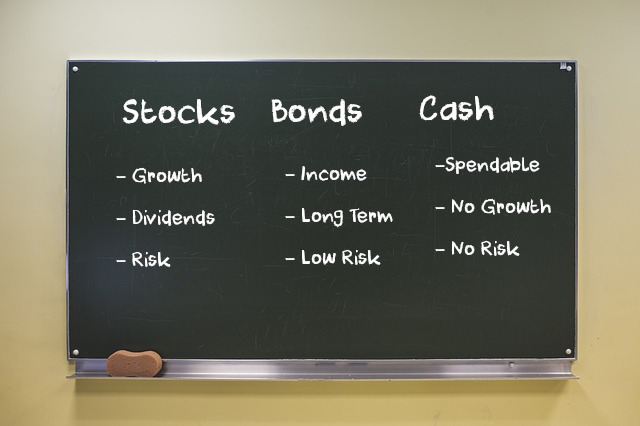

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more. Liquidity, Risk, and Potential Returns All investments balance liquidity (how easily it can be converted into cash for other use), risk (the Read More…

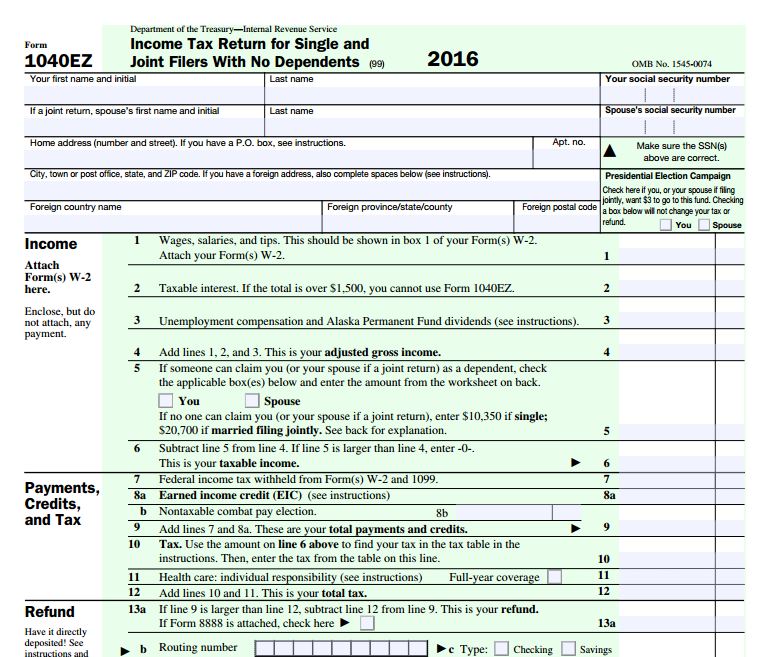

What is income tax? Income tax is the tax you pay on your income, usually directly taken out of your paycheck. Everyone who works in the United States should be paying income tax on their earnings. Income is more than just wages and salaries too. If you earn rents from rental properties, investment income, interest Read More…

What are Credit Cards? Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest. Credit Cards Vs Debit Cards Read More…

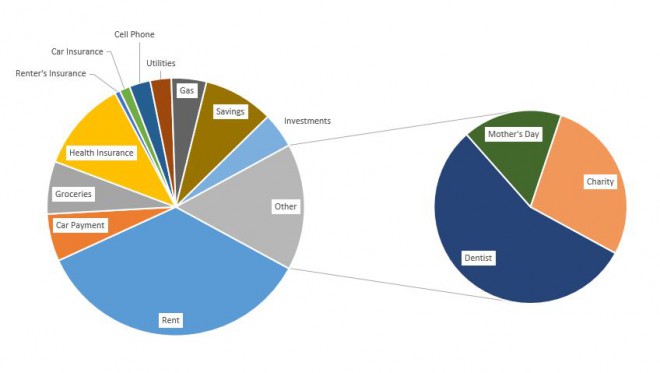

If you want to start building your first workable budget, it is important to know exactly what should be in it, how to keep it updated, and the specific reason you want to have this budget. What does a budget look like? A budget is usually a spreadsheet or table. On one side or column, Read More…

What Is Credit? “Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of Read More…

Credit Reports are basically a report that contains your credit history – both the good and bad. If you watch late-night TV, you have probably seen a few commercials offering free credit reports, so you might know that these are important. Most people, however, don’t know just how big a role a credit report can Read More…

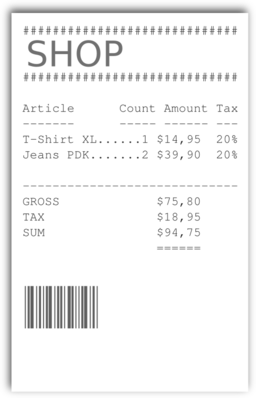

Financial Records are what you use to have an easy way to tell where all your money and assets are, and exactly how much you have, at any given time. They are not one document, or even one type of document. In fact, most people’s financial records will not look the same as anyone else’s, Read More…

A “Spending Plan” is exactly as it says – a plan of what you will be spending each month. There are usually two parts – your “fixed” spending and your “variable” spending. The fixed part is usually the same every month, with things like rent/mortgage payments, grocery bills, insurance, and car payments. The variable part Read More…

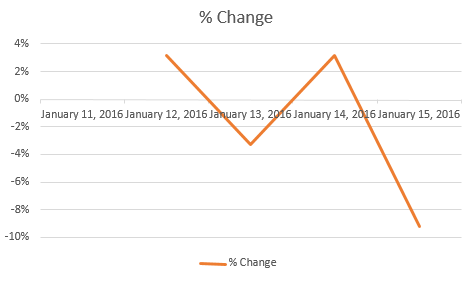

In this article we will be looking at how you can use Excel with your HTMW account to keep track of your account’s performance. Using Excel To Track Your Stock Portfolio – Getting Some Data Before we can do anything with Excel, we need to get some numbers! The information you use in excel is Read More…

Simply put, when you have money to invest for an extended period of time (like 20 years or more), the stock market historically has provided the greatest return. When most people are able to save money, they usually put it in the bank. Banks usually pay interest on the cash in your account, so if Read More…