If you’re an investor, then you may already know that your family will most likely be interested in what you do and how you earn money. Moreover, if your investment strategies have often made you place personal funds or assets as collateral, then you have no other way but to explain to them how the Read More…

Meet the Dogs No question about it, investing is a dog-eat-dog world. Traders are constantly developing and revising strategies in order to make the most money in the stock market. Throughout time many strategies have come and gone, few sustaining any significant longevity. However, over the past decades, Michael O’Higgins’ strategy coined “Dogs of the Read More…

Warren Buffet, also known as the Oracle of Omaha is a legendary investor who dishes out sage wisdom for investment success on Wall Street. Warren Buffet’s annual letter to shareholders of Berkshire Hathaway has become an annual letter to the world. A simple online search of “Warren Buffet’s investment advice will yield tons of results Read More…

It’s essential to establish a well-thought-out plan regarding your finances, no matter how young one is. The first thing you need to do is to identify your short-term goals. Though your long-term goals are just as important, the fundamental approach to achieving those hinges on your ability to hit short-term goals. Failure to define your Read More…

How To Pick Stocks – The Basics The most challenging aspect of starting to invest in the stock market is deciding what stocks to buy. Every experienced investor has his/her own techniques and strategies that they believe in. But when you are just getting started, learning how to pick stocks can be very challenging. Read More…

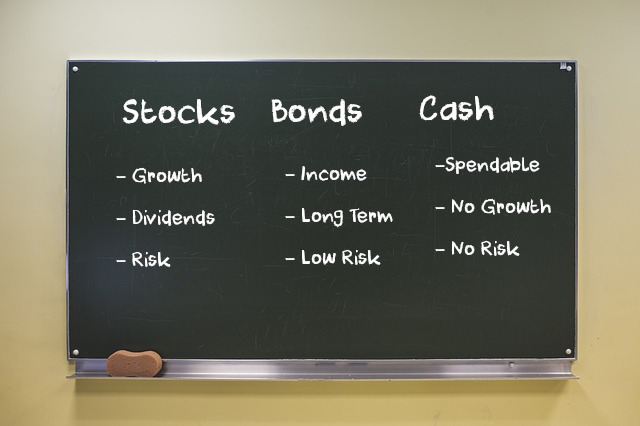

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more. Liquidity, Risk, and Potential Returns All investments balance liquidity (how easily it can be converted into cash for other use), risk (the Read More…

What Is Credit? “Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of Read More…

Credit Reports are basically a report that contains your credit history – both the good and bad. If you watch late-night TV, you have probably seen a few commercials offering free credit reports, so you might know that these are important. Most people, however, don’t know just how big a role a credit report can Read More…

What is a fraction? A “Fraction” means one piece of a whole. You can use fractions in any case where it might be useful to look at something in parts, rather than the whole thing at once. The most delicious fractions are slices of pizza. If the pizza is in 8 slices, we know that Read More…

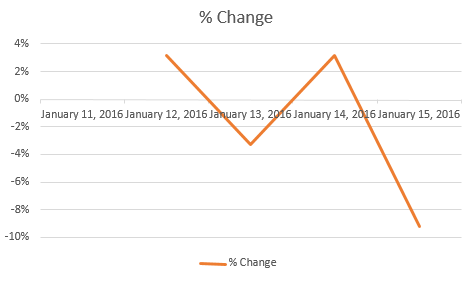

In this article we will be looking at how you can use Excel with your HTMW account to keep track of your account’s performance. Using Excel To Track Your Stock Portfolio – Getting Some Data Before we can do anything with Excel, we need to get some numbers! The information you use in excel is Read More…

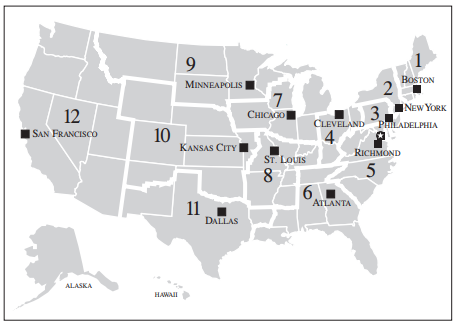

Definition The Federal Reserve Bank, or the “Fed”, is the central banking system of the United States. It serves as the primary regulator of the US dollar, as well as the “lender of last resort” for other banks. Regulating Currency The Federal Reserve works to maintain the interest rates that banks use to lend money to Read More…

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between more than one sector. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our Quotes Tool has all the information you need to Read More…

Simply put, when you have money to invest for an extended period of time (like 20 years or more), the stock market historically has provided the greatest return. When most people are able to save money, they usually put it in the bank. Banks usually pay interest on the cash in your account, so if Read More…

The basics about stocks. What are they? What do they represent? How does Risk figure into stock ownership.

ETFs have been one of the most popular investment vehicles in the world over the last decade or so, with investors of all types attracted to the low fees, but diverse holdings, falling somewhere between mutual funds and stocks in terms of how easy they are to manage in a portfolio. However, one of the Read More…

Live Forex trading includes negotiating of national bills which is performed on a live basis at 24 hour, around-the-clock period. Forex is derived from the words Foreign Exchange which is known as the global market that does business in money trading.

Definition A Stop (or stop loss) order and limit order are orders that try to execute (meaning become a market order) when a certain price threshold is reached. Limit and stop orders are mirrors of each other; they have the same mechanics, but have opposite triggers. When creating a limit or stop order, you will select Read More…

Promissory notes issued by a corporation or government to its lenders, usually with a specified amount of interest for a specified length of time. This is seen as a loan from the bond holder to the corporation. The value of Bonds traded are greater than the value of stocks traded.

Definition: An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs. There can also be intangible assets such as the value of a brand name or logo. Details: Assets generally refer Read More…