Long Stock What is a long stock? A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Words such as “shares”, “equity” and “stock” all Read More…

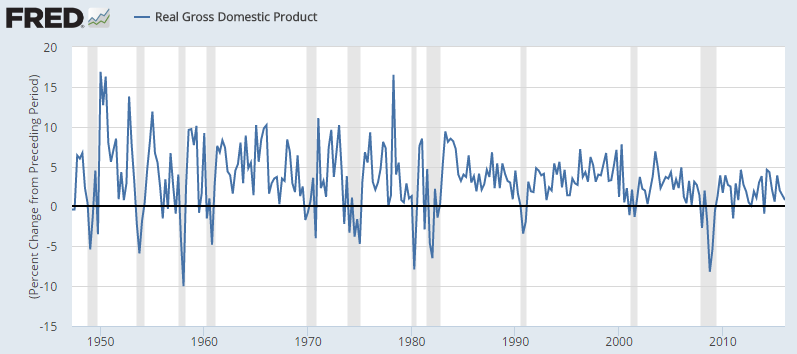

What Is The Business Cycle? The Business Cycle is the broad, over-stretching cycle of expansion and recession in an economy. The Business Cycle is concerned with many things – unemployment, industrial expansion, inflation rates, but the most important indicator is GDP (Gross Domestic Product) growth. Below you can see a graph of the GDP growth Read More…

What are Credit Cards? Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest. Credit Cards Vs Debit Cards Read More…

What Is Credit? “Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of Read More…

Definition “Economics” is often called the Dismal Science – it studies the trade-offs between making choices. The purpose of economics is to look at the different incentives, assets, and choices facing people, businesses, schools, and governments, and see if there is any way to improve outcomes. This is done by looking at how supply and Read More…

Definition A “Contract” is a legally binding agreement between two parties (people, companies, or both). Having a contract means that if one party does not keep their word, the other can sue them in court to either force them to fulfill their side of the agreement, or pay back compensation. What Makes A Contract Binding? Read More…

When talking about Banking, people generally group Banks, Credit Unions, and Savings & Loan companies all in one group. They do provide similar services, but they each have specific differences that might make them a better or worse fit for your financial needs. What They Have In Common All three of these institutions can do Read More…

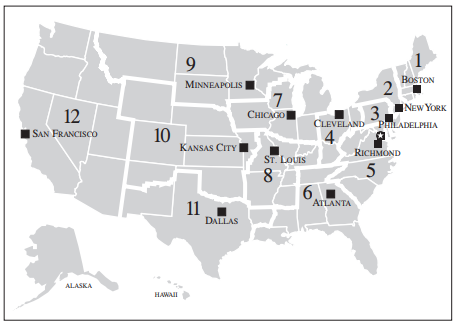

Definition The Federal Reserve Bank, or the “Fed”, is the central banking system of the United States. It serves as the primary regulator of the US dollar, as well as the “lender of last resort” for other banks. Regulating Currency The Federal Reserve works to maintain the interest rates that banks use to lend money to Read More…

Definition Cottage Industry, or the “Putting Out System” is a production system of producing goods that relies on producing goods, or parts of goods, by craftsmen at home, or small workshops, instead of large factories. History “Cottage Industry” describes the methodology that was used to produce most goods throughout human history, up until the end Read More…

Live Forex trading includes negotiating of national bills which is performed on a live basis at 24 hour, around-the-clock period. Forex is derived from the words Foreign Exchange which is known as the global market that does business in money trading.

Promissory notes issued by a corporation or government to its lenders, usually with a specified amount of interest for a specified length of time. This is seen as a loan from the bond holder to the corporation. The value of Bonds traded are greater than the value of stocks traded.

Definition: An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs. There can also be intangible assets such as the value of a brand name or logo. Details: Assets generally refer Read More…

Good Till Date Order Terms If you have ever placed a limit or stop order on HowTheMarketWorks, you have see the “Good Till Day” order term on the trading menu: A “Good-Till-Day” order is simply one that will cancel at the end of the trading day if it does not fill. So, for example, if Read More…

The Dow Jones Industrial Average, also called the Industrial Average, the Dow Jones, the Dow 30, or simply the Dow, is a stock market index that shows how 30 large publicly-owned companies based in the United States have traded during a standard trading session in the stock market.

Gross National Product is the value of all goods and services produced by a country’s residents.

Free Cash flow is the cash available to all the capital providers of a company. There are two types of free cash flows: 1) Cash flow available to pay out to all capital providers and 2) Free Cash Flow to Equity (FCFE).

The Form-8K is a SEC-mandated report filed by public companies to report unexpected events or transactions that are material in nature, and thus have an impact on the share prices of the company.

Fixed income analysis is the process of evaluating and analyzing fixed income securities for investment purposes.

In investment valuation, financial modeling refers to the procedure and methodology performed to determine the value of an asset or financial security. Fundamentally, a business or company’s current value can be viewed as being derived from its future cash flow streams. An investor deciding whether to purchase or sell a stock, therefore, will be interested in estimating such value.

The earnings reports released by companies can be invaluable in providing such information. Released by public companies on a quarterly and annual basis, they can be used to assess and gauge a company’s: financial condition, strategic plans, industry and competitive position, Key performance drivers and risk factors and Future performance.