The buy and hold strategy is essentially just what it sounds like: Purchase stocks and then hold them for an extended period of time. The underlying assumption for the buy and hold strategy is that stocks tend to go up in price over extended periods of time. Research supports this trend in a growing capitalist economy and the strategy has made millions rich. There is also something to be said about not having to ride the emotional roller coaster with every increase and dip in the market…just buy the stock and check on it once in awhile. Is a buy and hold strategy right for you? Take this quick quiz to find out:

1. You are investing with long term goals in mind.

2. You are unlikely to need the additional cash on short notice.

3. You would like to reduce commissions and other fees.

4. You would like to reduce or defer taxes.

If you answered “yes” to any of the above then a buy and hold strategy might be a good fit for at least a portion of your portfolio. A Buy and Hold strategy is a traditional long-term investment strategy of buying a stock long and holding on to it for an indefinite period of time, usually 3-5 years. This classic strategy is associated with a bottom-up investment management style where the portfolio analyst uses the financial statements to forecast growth in earnings and buys the stock long-term, anticipating growth and therefore price appreciation for the stock over a period of time. Buy and Hold strategies are most often strategies used with registered non-taxable accounts, such as a 401k or RRSP’s, where the manager is limited to long only positions and does not have the ability to use derivatives or to sell short stock. For example, after extensive research and due diligence, a portfolio manager learns that a new small-cap company, Stock-Trak Group, has some earnings and is expected to be a leader in their industry. The portfolio manager decides that this is a potential great investment and sees good growth for the firm in the long-term. After analyzing his valuation models, the manager believes Stock-Trak Group is highly undervalued and that with growth in revenue and earnings over the next 3 years, the stock’s price will appreciate very quickly. He decides to purchase the stock today and hold for the 3 year term, unless some unanticipated events occur, and sell with a target gain of 300% (tripling the client’s money).

Cup and Saucer

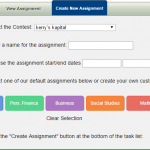

Cup and Saucer Assignments Get An Upgrade!

Assignments Get An Upgrade! Why Bitcoin Analysts Continue to Remain Bullish

Why Bitcoin Analysts Continue to Remain Bullish