Definition

An uncovered call is a short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash equal to the exercise value of the call. These type of options are also called naked call and are the opposite of covered calls. This option strategy is one of the riskiest option strategies you can take as there is unlimited risk.

Explanation of an Uncovered Call:

An uncovered call is most commonly created by writing a call option without owning the underlying stock.

Covered calls, where the writer of the option also owns the stock and thus protects himself from large rises in the stock’s price are protected from large losses. Using uncovered calls, on the other hand can have limitless losses as the price of the stock rises.

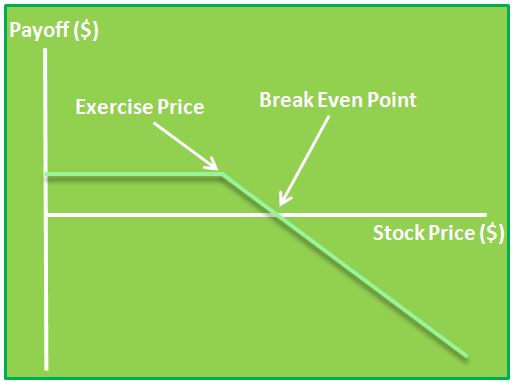

Here is the option payoff diagram associated with this strategy:

As you can see above, as the stock price increases (towards the right) the loss can keep going indefinitely.

Broadening Formations

Broadening Formations Motley Fool Stock Advisor Review

Motley Fool Stock Advisor Review