Definition When we think of money, stored value means anything that isn’t cash, but you can still use to transfer value – checks, debit cards, gift cards, and forms like that. These are used to transport some dollar amount which we can later exchange for goods and services. Each of these forms of stored value have their Read More…

Definition: Money creation is accomplished through a system of borrowing and lending. Until the 1970’s, it was based on the total reserves of gold and silver. Details on Money Creation: Money is created principally by standards set by the federal reserve / central bank. The central bank will determine the amount loaned to it’s commercial Read More…

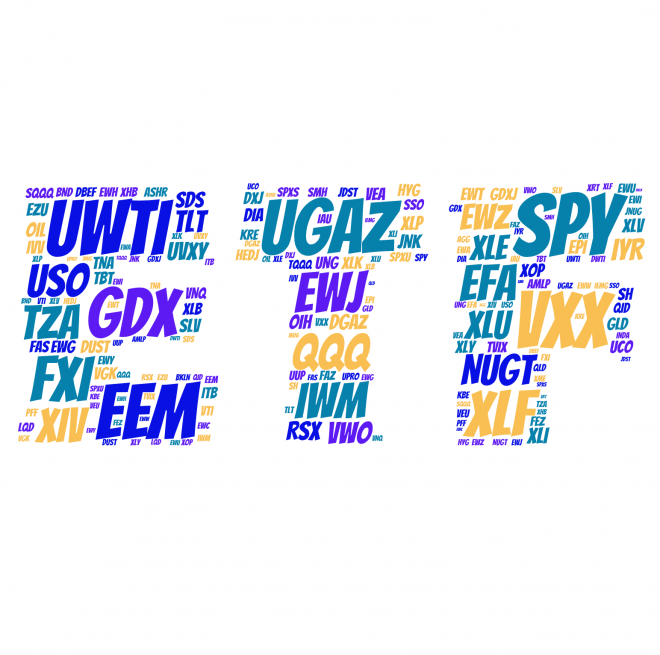

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indecies (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions. However, using financial derivatives and debt, there are also “Leveraged ETFs”, Read More…

Insurance is protection from losing or damaging something. It is defined as the transfer of loss risk in exchange for payment. Basically, if we damage or lose something that was insured, the insurance will cover the cost of having it fixed or replaced.

Monopoly, in economic terms, is used to refer to a specific company or individual has a large enough control of a particular product or service that allows them to influence it’s price or certain characteristics.

Monopolistic Competition is characterized as a form of imperfect competition.

Money supply is the total amount of money available in an economy at any particular point in time.

Monetary Policy refers to the process by which the Monetary Authority of a given country implements a variety of measures to control the supply of money.

Modern Portfolio Theory (MPT) is an investment theory whose purpose is to maximize a portfolio’s expected return by altering and selecting the proportions of the various assets in the portfolio.

An investment strategy that aims to capitalize on the continuance of existing trends in the market. The momentum investor believes that large increases in the price of a security will be followed by additional gains and vice versa for declining values.

A security with a guarantee of a return rate that is higher than the rate of inflation if it is held to maturity

A hedge fund is one of the investment tools you will aspire toward as a serious investor. The first hedge fund came out in 1949 as a strategy to neutralize the effect of overall market movements on a portfolio.

Hyperinflation refers to out of control or extremely rapid inflation, where prices increase so quickly that the concept of real inflation becomes meaningless.

Inflation refers to the general rising of prices for goods and services in the economy, due to an increase in the amount of money and/or credit available.

In a cap-weighted index, large price moves in the largest components (companies) can have a dramatic effect on the value of the index.

Your ideal investment or investment portfolio gives you the most opportunity for the risk you can bear. In this sense, it is important to understand the risk inherent in an investment before you look for the opportunity.

A non-bank organization that regularly trades large blocks of stocks.

A way to evaluate potential profit on an investment by making a projection of growth over several years. For example, if a company makes a 7% profit increase in the prior quarter, an accountant could project 7% profit increase for the next quarter.

A series of technical indicators used by traders to predict the direction of the major financial indexes.

By aggregating the value of a related group of stocks or other investment vehicles together and expressing their total values against a base value from a specific date. Market indexes help to represent an entire stock market and thus give investors a way to monitor the market’s changes over time.