***Motley Fool Stock Advisor Performance Updated as of August 13, 2021*** Does the Motley Fool’s Stock Advisor newsletter provide good stock recommendations and is it worth the price? At HowTheMarketWorks, one of the services we provide our users is that we subscribe to dozens of stock advisory services and we buy all of the recommended Read More…

Presidential Poll of College Students Trump Leads by 3.4% Presidential Poll of High School Students Trumps Leads by 19.1% Stock-Trak Inc., the leading provider of educational stock market simulations for the high school and college markets, posted polls on its websites from November 1 to November 3 asking its users for whom they would vote. Participation in Read More…

Add a Financial Literacy Lab To Your High School Transform your current computer room into a Wall Street Trading Room! Experiential Learning at its Best Your high school probably has a “physics lab” or a “chemistry lab”, so why doesn’t it have a Finance Lab? Engage your personal finance, business, accounting, economics, computer and math students Read More…

Stop Wasting Money on High Interest Rate Credit Cards All credit cards are NOT the same–find the credit card that is right for you! If you get good grades, then choose a credit card that gives you a reward bonus for good grades.If you can’t pay off your credit card bill each month, then make Read More…

How Credit Cards Work Since 2010 the use of credit cards has become more popular than writing checks when paying for everyday purchases. The banks have made it easy for most people to get a credit card, and most retailers have made it very easy to use them. What is a Credit Card? A credit Read More…

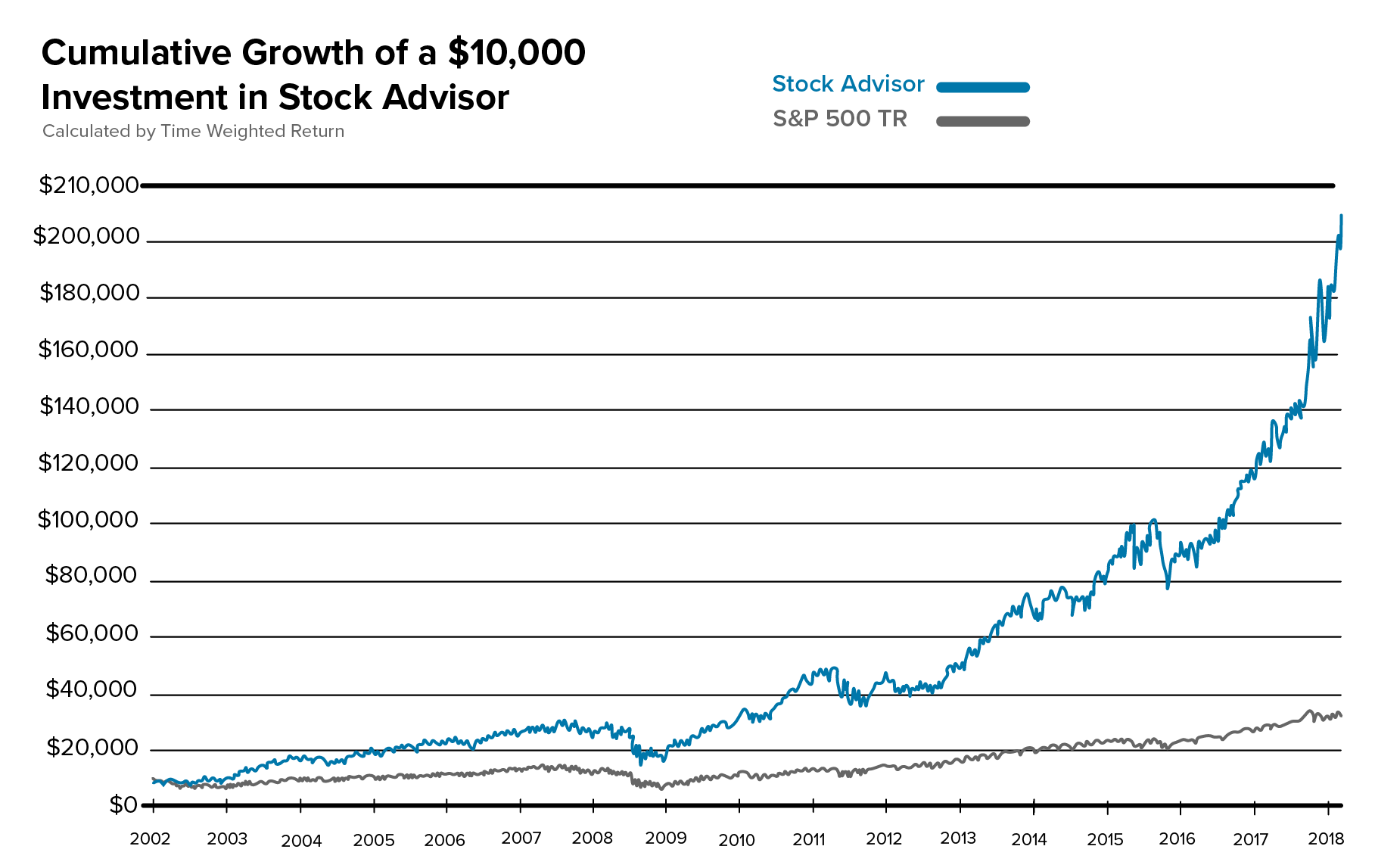

Simply put, when you have money to invest for an extended period of time (like 20 years or more), the stock market historically has provided the greatest return. When most people are able to save money, they usually put it in the bank. Banks usually pay interest on the cash in your account, so if Read More…

StockLinkU, the stock simulation site launched in 2012 from Greenville SC, has apparently shut down. StockLinkU has apparently closed its virtual trading site. The site has been unavailable for several months now and there are no comments from its facebook and linkedin pages. Launched in 2012 as a free site, the site struggled to gain Read More…

Born To Sell is all about covered calls. Their award-winning covered call screener has an easy-to-use interface and provides covered calls matching any query you give it. Every day there are over 350,000 covered calls to choose from. That represents thousands of underlying stocks and ETFs, each with dozens of strike prices and expiration dates Read More…

McGraw-Hill and Stock-Trak, the leader in educational portfolio simulations, have joined together to offer students that purchase a McGraw-Hill college finance textbook a FREE account at Stock-Trak’s new real-time, streaming stock simulation at HowTheMarketWorks.com, used by over 200,000 students and beginning investors each year! Buying and selling stocks is a fantastic educational experience for students Read More…

Opening a Brokerage Account is Easier Than you Think Be Ready for the next 5% pullback in the stock market and open your real brokerage account today! Given that most market analysts are predicting a pullback of 5% or more from the recent market highs in the coming days, now may be the best time Read More…

TEACHERS: Come to New York this Summer and Attend a 5 Day Training Session at the New York Stock Exchange–Financial Aid is available to cover travel!– Financial Aid requests due May 1st. Registration Forms due May 17th NYSE-SEC Summer Teacher Workshops are offered for teachers who want an in depth stock market experience and are Read More…

Try these 100% FREE educational and stock trading newsletters to get stock tips emailed to you weekly and start learning How The Market Works! Click on the offers that interest you, fill in any required information, and then scroll down and click the “Continue” button to start getting some free stock tips!:

Income statement (also referred to as profit and loss statement (P&L), revenue statement, statement of financial performance, earnings statement, operating statement or statement of operations is a company’s financial statement that indicates how the revenue (money received from the sale of products and services before expenses are taken out, also known as the “top line”) is transformed into the net income (the result after all revenues and expenses have been accounted for, also known as Net Profit or the “bottom line”).

Profit or loss resulting from the sale of certain assets classified under the federal income tax legislation as capital assets. This includes stocks and other investments such as investment property.