The prevailing opinion about credit cards is that 7 in 10 Americans have at least one credit card— the largest number of the millennials’ demography could even own two credit cards. Beyond the obvious convenience that credit cards offer in making it easy to function in a cashless economy and access credit that you could Read More…

The battle cry to cut the plastic, spend only cash, and never buy anything on credit has become increasingly louder over the last couple of years. There are far too many sad and unfortunate stories about how people fell into financial ruins because they overspent on their credit cards or didn’t manage late fees properly. Read More…

Warren Buffet, also known as the Oracle of Omaha is a legendary investor who dishes out sage wisdom for investment success on Wall Street. Warren Buffet’s annual letter to shareholders of Berkshire Hathaway has become an annual letter to the world. A simple online search of “Warren Buffet’s investment advice will yield tons of results Read More…

Financial stability is a highly desired commodity for both individuals and businesses, and in both cases, money management is often a key to that stability. Multi-million dollar businesses don’t get to that level of success through improper spending and a blissful lack of awareness regarding their cash flow. It takes careful management, budgeting, and sacrifices Read More…

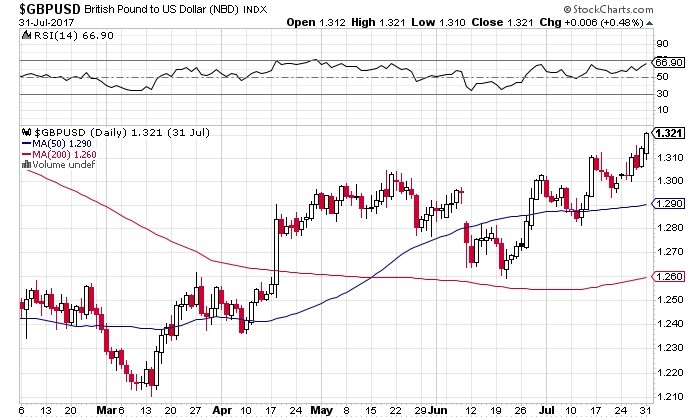

The GBP/USD pair is currently trading at 1.3205, close to its 52-week high of 1.34427. The sterling has enjoyed an imperious run of form in 2017, starting at around 1.23, and gaining approximately 7.3%. The US dollar index indicates an overall poor run of form by the greenback, with a year to date decline of Read More…

There’s been a lot going on in the technology sector lately, with the NVIDIA Corporation (NASDAQ: NVDA) sell off and the selloff in late June after Alphabet Inc Class A (NASDAQ: GOOGL) got hit with a $2.7B fine, which pushed the stock down over 2% after the announcement. Volatility in NASDAQ-100 Now, in early June, Read More…

Nobody ever said that being an entrepreneur would be an easy task – it is probably tougher to be an entrepreneur (at the start) than to work a 9-to-5 job. One of the things that make it hard to be an entrepreneur is the money matters that arise over the course of starting and running Read More…

Investing in stocks has traditionally been done through actual purchase and possession of stocks of a particular company. However, this comes with the risk of having to stick with the stock even when the price is falling and you do not find a ready buyer in the market immediately. In addition, for some other stocks Read More…

Crude oil prices have been climbing up steadily in the last couple of months as investors continue to expect a balance in the demand and supply dynamics of oil. Last year, OPEC announced that it has worked out a deal with its member nations and some other producers to cut production volumes in order to Read More…

Gold is currently trading at $1,215.85 per ounce, up 0.96% or $11.55. The precious metal has gained 6.40% over the past 30-day period, up $72.40. For the year to date, gold is up 4.7%, and it has an average return of 10.7% since 2002. Its best year on record in that time is 2007 when Read More…

When it comes to currency trading, there is a vast range of different strategies you can adopt to generate trading profits. For example, you could pursue an event-focused strategy, where you place trades just after large market-moving macroeconomic or political events. Alternatively, you could put on medium to long-term trades based on your view of Read More…

The most widely traded financial asset in the world is not any particular stock, oil or gold – it is the EURUSD (Euro/ US dollar) currency pair. The pair represents two of the largest economies of the world. Created to facilitate cross-border trading among European and American partners, the euro (EUR) has risen to become Read More…

In the last six months we have witnessed strong volatility in the global currency markets. Emerging markets currencies weakened aggressively against the U.S. dollar, which has strengthened substantially leading up to the Federal Reserve’s U.S. benchmark interest rate hike in December of last year. Volatility in the currency markets is not just an issue for Read More…