Learning a new skill can oftentimes be scary but luckily you have the chance to not pick-up any bad habits early on with these best practices. This will allow you to start learning how to trade quickly and easily. With the following best practices you’ll be on the fast-track to becoming a savvy investor in no time!

Sticking to a Strategy

An important thing to do when your starting off is to make sure you pick a strategy and stick with it. Switching strategies from one week to the next is a sure fire way to not only do poorly, but not learn along the way. It is better to pick a strategy for a good period of time and work with it than to try to switch to a new style as soon as things are not going perfectly.

This does not mean that you should pick one strategy and stick with it no matter what; but by using a portfolio simulator like HowTheMarketWorks, you can set up multiple portfolios, each with its own strategy, and see which one starts outperforming the others over a longer period of time. This lets you get great experience before settling on a strategy that risks your real money, and lets you look at your investments from multiple perspectives while you compare against yourself.

How long you try a trading strategy will depend on the strategy itself. If you are trying a buy and hold strategy you are likely to try it for much longer than a day trading strategy. Another reason this is important is because different strategies take time to master and if you quit before you even have the chance to get good at it, you will most likely not become a successful trader.

Keep it Simple

The best strategies are usual quite simple. Trading random stocks can be just as viable a strategy as relying upon complex analysis and tools. The reason behind this is simple: a lot of tools and indicators contradict themselves and can easily overwhelm you with the shear mass of information. As we said above, picking one tool or strategy is the best way to get started when starting out. If you don’t know what tool or strategy to pick, just pick randomly and see how you like it!

Emotions

Let’s face it, losing money can be devastating emotionally and making money can be exhilarating. However, these emotions help you very little in making sound investing decisions. Panicking and selling every time the price goes down by more than a percent is the quickest way to lose money. But it would be impossible to take the emotions out of trading completely without being robot. Despite not being able to become robots, that is exactly what many traders strive to do. By setting rules, stops and limits orders when one is calm you can avoid making emotional decisions and instead rely on the analysis you made before the market started soaring 10% in one day. With very advanced software or even your own software, you could set investment strategies based solely on your analysis and never have to even look except to make sure it is performing as expected. This may seem a little cold but making investing decisions without emotions clouding our judgment is the best way towards better returns.

Trend

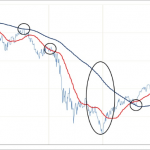

The old adage that the “trend is your friend” is still as true as ever. When in a bull market go long and when in a bear market go short and if the market isn’t moving much stay neutral. Though this may seem simple, many traders struggle to do this. The logic behind this is simple: generally swings in markets occur over a few days or weeks whereas movement of a much larger pattern will occur over months. It is very difficult to predict the exact moment when a trend will reverse so the easiest thing to do is to just ride the trend while you can and get off when it first shows signs of stopping.

Moving Averages

Moving Averages Financial Records

Financial Records Investing in Latvia

Investing in Latvia