Contest: February Trading Contest

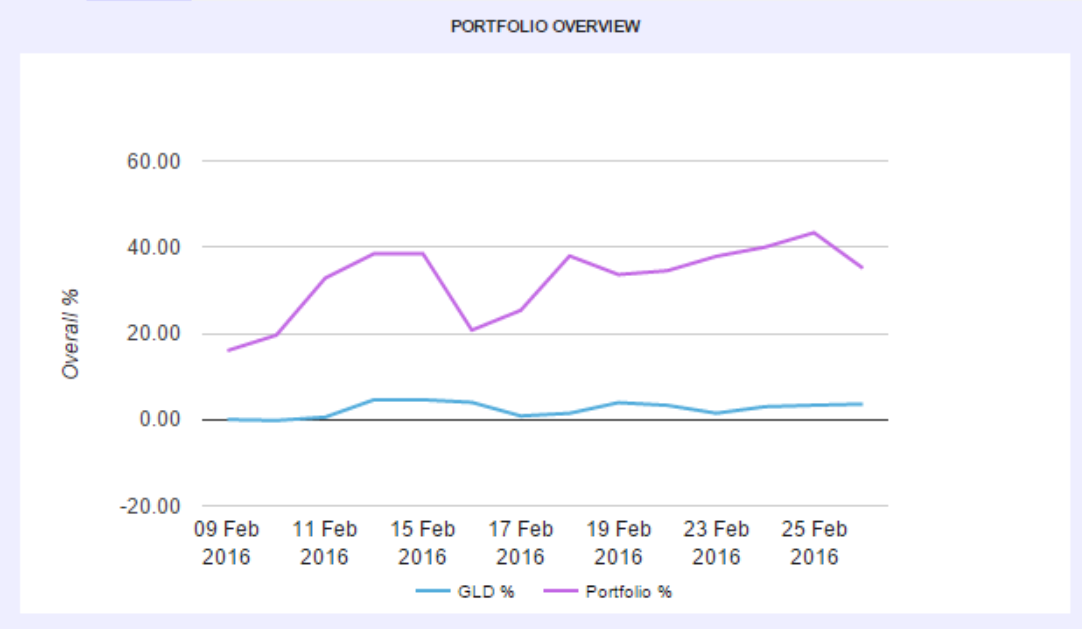

Final Portfolio Value: $135,104.98 (+35.1%)

Trading Strategy For This Contest

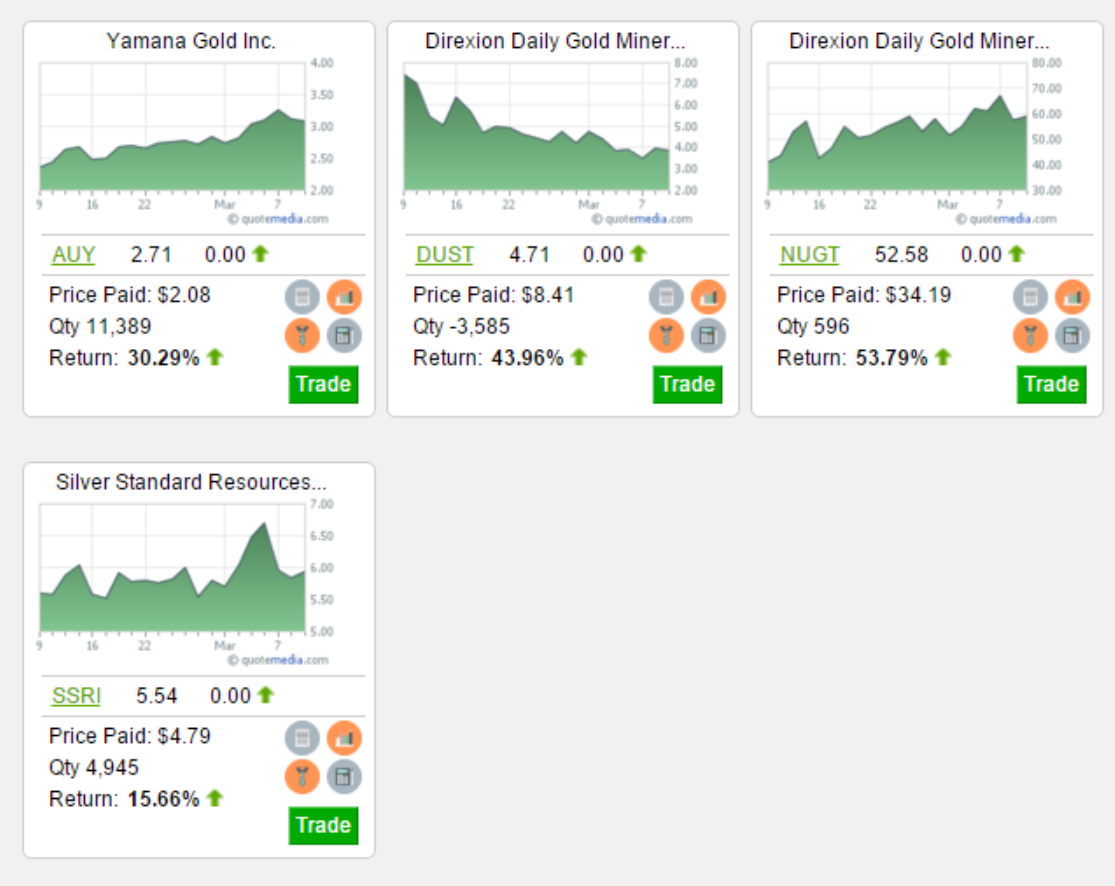

I made 4 trades at the start of the month all based on gold being undervalued. I suspected a medium term rally and I therefor bought leveraged gold stocks/etf. The only reason I made 4 trades was because I was forced to only have so much % of a stock allocated to my portfolio. The specific bets I made were silver standard/yamana. As well as leveraged ETF NUGT, I short sold DUST.

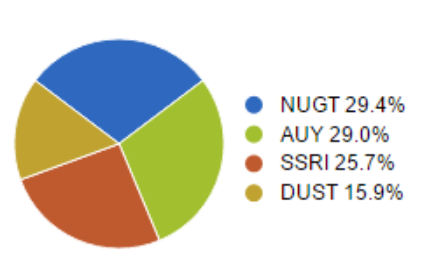

Final Open Positions and Portfolio Allocation

Performance Over The Total Contest

See More Trading Strategies From This Contest

Michael’s February Trading Contest Strategy - Contest: February Trading Contest Final Portfolio Value: $135,104.98 (+35.1%) Trading Strategy For This Contest I made 4 trades at the start of the month all based on gold being undervalued. I suspected a medium term rally and I therefor bought leveraged gold stocks/etf. The only reason I made 4 trades was because I was forced Read More...

Housemanager’s February Contest Strategy - Contest: February Trading Contest Final Portfolio Value: $143,899.64 (+43.9%) Trading Strategy For This Contest Study sectors precious metals and energy- they have greatest potential for change because of most “auction” mentality” in stock and options activity. Research understanding small cap stocks. Read up on them and knowledge of these individuals is key. Final Open Positions Read More...

Covered Calls

Covered Calls