It is one thing to be an investor and another to actually know what to invest in. This is a dilemma that many investors are met with, especially gold investors. Gold is a very interesting commodity to invest in, and there are many ways to invest in it. There are companies like Karatbars that sell small gold items, gold exchange-traded funds (ETFs), and many other ways one could get into gold.

Due to its interesting nature, it has many methods with which it can be invested in, and, many times, investors find themselves at crossroads about what aspect of gold they should put their money on.

Gold has a very rich history that helps sway investors’ emotions toward it, seeing as it was once used as money and as a medium of exchange for goods and services. The fact that it can be used for various purposes, especially as a hedge against inflation, is also a reason why investors see it is a good investment option.

Two forms of gold investments that most investors are torn between are the investment in physical gold and gold certificates. So, which is a better investment option out of the two? Let’s find out.

Physical gold

Physical gold is gold that an investor can feel, touch, and actually own. It is also referred to as gold bullion and can be purchased at a spot price, which may vary depending on the seller. The spot price is the price of the unfabricated gold plus any other additional costs.

Physical gold is considered to be of investment quality when it has a fineness of at least 99.5 percent. Before buying physical gold, investors should ensure that the name of the manufacturer, the weight, and the purity of the gold is featured and stamped on it. There is also the so-called LBMA “Good Delivery List” that certifies companies, like Karatbars, that meet a specific standard.

CashGold by Karatbars

Reputable companies like Karatbars International, which is the leading company in the market of small gold items. have also gone the extra mile to make gold more accessible to investors who are willing to invest in gold but don’t have enough financial capacity to do so. With their CashGold, Karatbars offer small denominations of gold, which can less than 1g of gold.

Gold certificates

Gold certificates, on the other hand, are paper documents that entitle their bearer to a specified amount or value of actual gold. They are issued to investors as proof of ownership of gold stored by banks. The face value of gold certificates was measured in U.S. dollars and could be used as a legal tender back when the U.S. dollar was tied to the gold standard before it was abandoned in 1933.

Although some banks and investment companies in the United States and abroad still issue gold certificates, they are generally specified in ounces, as their dollar value fluctuates with the market. With this, investing in gold certificates is seen as an investment in precious metals rather than an investment in currency.

Now it should be even clearer why investors who are torn between both worlds should invest in physical gold over gold certificates. First off, this way, they can actually account for their gold, but some of the other reasons why investing in physical gold is a better option, are:

Advantages of physical gold over gold certificates

- Physical gold is a safe haven: Gold certificates do not offer the level of safety expected of gold by investors, as it is not capable of protecting investors during times of economic downturn or other financial crisis.

This is a security that physical gold offers and is a reason why serious investors with the intention of protecting their portfolio during such a situation should rather invest in physical gold.

- Outright ownership: As stated earlier, an investor can own physical gold and register it in his/her name and title. A gold certificate, on the other hand, is only a paper proxy for gold. Of course, the security that comes with owning your own property cannot be overemphasized.

- No counterparty risk: Investors who own their own gold bullion can never suffer a default as there is no counterparty to make good on a paper contract. Investors who own their gold do not require the backing of any banking institution, government, or a brokerage firm.

Conclusion

Although it is very much understandable when investors struggle to decide on the kind of investment that is good for them, it should be rather obvious why investors should rather invest in physical gold over gold certificates.

Why Invest In Stocks?

Why Invest In Stocks? Car Loan Calculator

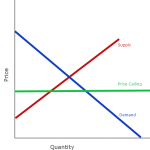

Car Loan Calculator Price Controls

Price Controls