One of the most-requested new features in Spring 2018 was cryptocurrency trading, both from students and teachers. You asked and we listened – crypto trading is now available on HowTheMarketWorks!

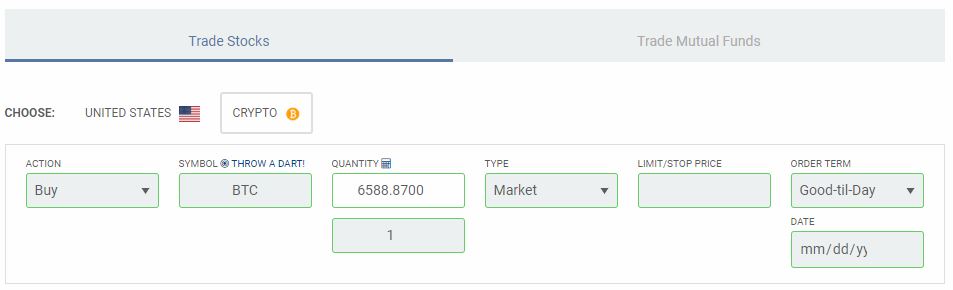

Cryptocurrencies currently share some of the rules from Stocks, such as the commissions and position limits. However, you can trade cryptos both using a quantity (such as 10 “coins”), or specify a dollar amount (“I want to buy $25,000 worth of Bitcoin”).

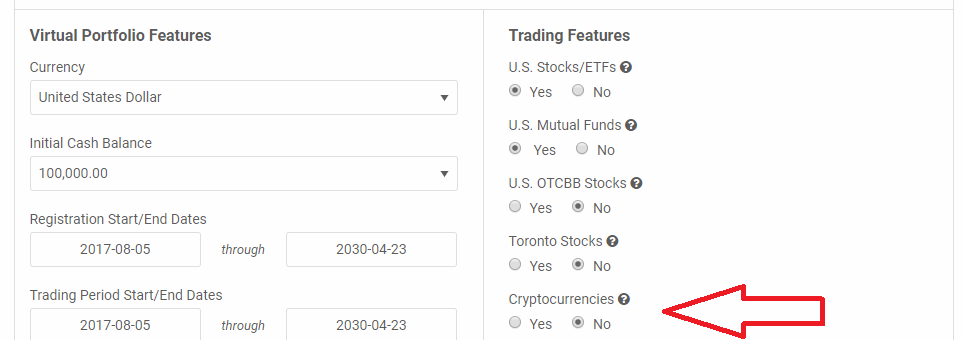

If you are creating your own contest, you can choose whether participants can trade cryptocurrencies (we have them turned off by default):

You can toggle this on or off from your “My Contests” page, and clicking “Edit Contest”.

Happy Trading!

Jobs data released, Stocks Up!

Jobs data released, Stocks Up! Volatility Could Come Back in the Tech Sector

Volatility Could Come Back in the Tech Sector