The battle cry to cut the plastic, spend only cash, and never buy anything on credit has become increasingly louder over the last couple of years. There are far too many sad and unfortunate stories about how people fell into financial ruins because they overspent on their credit cards or didn’t manage late fees properly. However, the truth remains that credit cards bring an undeniable layer of convenience to financial transactions.

Credit cards are simply tools for accessing short-term loans for covering expenses so that you can pay off the bill at the end of the month technically without interest. Many credit cards also offer a suite of interesting perks and benefits such as cashback rewards on qualifying orders. However, beyond the convenience and cashback rewards, there are many hidden benefits of using a credit card many users have missed over the years. Below are four benefits you may not know that a credit card offers you.

1. Fraud prevention and protection

Cyber criminals are always roaming around the internet looking for vulnerabilities through which they can harvest people’s personal information and financial data. When data breaches happen, and your financial information is stolen, you may not even know until the bill arrives at the end of the month and you start seeing expenses you didn’t make. Many credit card companies have built customer profiling and risk prevention algorithms that know where and how much you are likely to shop. Hence, your credit card company is more likely to flag and halt a fraudulent transaction than a bank is likely to detect an unauthorized expense on your debit card.

Even when thieves succeed in charging expenses to you credit card, you can dispute the unauthorized expense and trust the charges to be reversed. The folks at Money Under 30 have graciously compiles a comprehensive list of credit cards that provide fraud protection perks. However, if an unauthorized charge goes through on your debit card, the bank is not likely to return the money to you until it has completed investigations.

2. Extended warranty on qualifying purchases

When you buy stuff from retailers, they’ll most likely try to upsell you with extended warranty offers that prolongs your warranty for a fee. Hence, if the manufacturer’s warranty is for one year, an extended warranty cover for two years could still cover the costs of repairs or replacement if the device becomes faulty after the manufacturer’s warranty has expired. Interestingly, some credit card issuers will offer you extended warranty as a perk on electronics or home furnishing purchases charged to their cards. Of course, such purchases tend be capped at a certain amount across different categories; hence, you may want to contact your card issuer to find out about the specifics.

3. Car rental insurance

Car rental collision insurance is probably one the simplest ways to lose money because you don’t think twice about how expensive it is – you’ll typically spend between $15 and $30 a day on auto rental insurance. If you charged the entire cost of your rental car to your credit card, you might be eligible to get free car rental insurance. Hence, you should take a moment to double check on the perks attached to your credit card before you allow to the car rental company to upsell insurance to you.

4. Travel or missed-connection insurance

If you are a frequent flier and you have a travel-centric credit card, it might be a needless waste of funds buying travel insurance or missed-connection insurance when you travel. Your credit card will most likely offer complementary travel insurance that covers emergency medical situations, trip interruptions, lost/stolen baggage, flight delay, hotel/motel insurance or travel accident among others. Some of these elements of travel insurance when bought individually can cost you upwards of $500 – this is money that you could save if you take a moment to read the fine print or call your credit card issuer to know if they offer such perks.

5. Price protection with refunds after price drop

Sometimes you’ll want into a store to buy stuff and go home feeling proud of your financial prudence only to walk into the store three weeks later and see the same item on sale at 40% off. If you paid with your debit card, you’ll only hate the fact that you bought the item too early and hope to catch a better deal next time. However, if you bought the item with your credit card, you might be able to get your credit card company to give you a refund of the difference between the old and new price up to a certain cap. In fact, many credit card issuers offer price protection refunds on qualifying items for up to $1000 in a calendar year for each account holder.

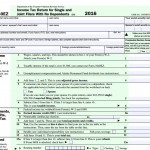

Income Tax Filing and the 1040

Income Tax Filing and the 1040 Hedging with ETFs

Hedging with ETFs