Bear ETFs short stocks to achieve their goals. Bear ETFs show gains when the underlying stocks loose value. Bull ETFs use long positions and show gains when the underlying stocks show gains.

The DIA -DIAMONDS Trust, Series 1 ETF invest in a basket of Dow Jones Industrial Average stocks that will track the price and performance of the Dow Jones Industrial Average (DJIA) Index.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more

An annual list put together by FORTUNE Magazine of the 500 largest companies. This list uses the most recent figures for revenue and includes both public and private companies with publicly available revenue. These are the top 500 companies in the USA.

A list of the 25 most popular (largest) mutual funds.

Mutual Fund screeners are available on countless websites and trading platforms. They allow users to choose trading instruments that are suitable for certain criteria profile.

The possible choices for investing in a mutual fund is less complicated than you think.

Mutual fund charges and costs are fees that may be acquired by investors who possess mutual funds

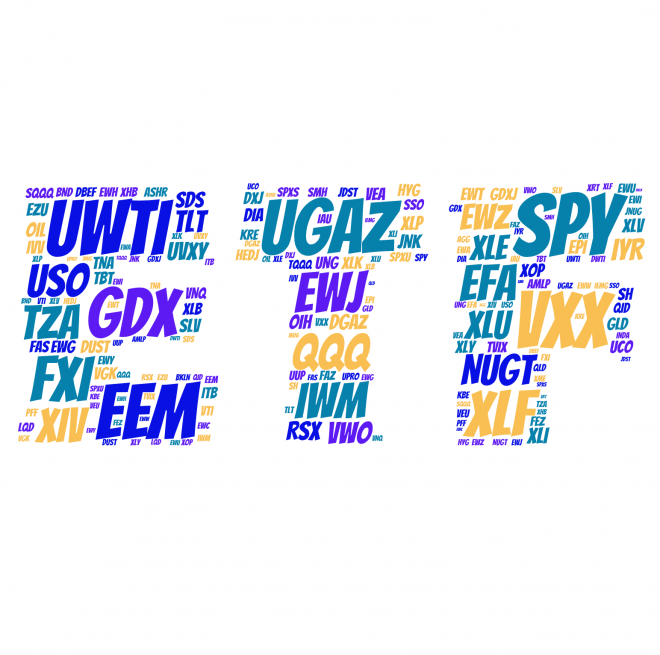

ETFs with the most trading volume and the most total assets.

An open end mutual fund don’t have limits on the quantity of shares the fund will issue. Provided that demand is requested often, the fund will continue to issue shares no matter the number of investors.

A tool that investors and traders can use to filter ETFs based on user-defined metrics. ETF screeners are offered on many websites and trading platforms, and they allow users to select trading instruments that fit a certain profile set of criteria.

A mutual fund is a form of professionally executed investment tool that merges money from numerous investors to buy securities.

A Spider ETF is a summary of Standard & Poor’s depositary receipt, an exchange-traded fund (ETF) administered by State Street Global Advisors.

Most Popular ETFs by Volume Symbol Name Avg Volume Total Assets SPY SPDR S&P 500 122,437,320 $120,699.8 M XLF Financial Select Sector SPDR 49,102,004 $8,232.3 M EEM MSCI Emerging Markets Index Fund 42,278,938 $37,379.9 M IWM Russell 2000 Index Fund 40,192,414 $17,667.3 M QQQ QQQ 34,720,602 $34,638.4 M VWO Emerging Markets ETF 19,842,342 $57,872.7 M Read More…

Exchange-traded funds that invest in physical commodities such as natural resources, agricultural goods as well as precious metals.

A group of risks combined with investing in a foreign country.

A type of mutual fund with a portfolio constructed to match or track the components of a market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund is said to provide broad market exposure, low operating expenses and low portfolio turnover.

What are the differences between investing in Exchange Traded Funds verses stocks? This article will discuss the pros and cons …

Your goal should be to build and manage a diversified portfolio of stocks and bonds with the lowest possible fees and the greatest possible tax efficiency. ETFs offer seven advantages over index mutual funds: lower cost, greater tax efficiency, better tax management, easier asset allocation, easier portfolio rebalancing, no fraud and you can short ETFs.

A stock like security that follows an index, a commodity or a basket of assets like an indexed mutual fund. Securities like ETFs trades like a stock. ETFs prices change throughout the day, like a stock, as they are bought and sold.