Had the American Indians sold their beads and trinkets they received from selling Manhattan Island, invested their $16 and received 8% compounded annual interest, not only would they have enough money to buy back all of Manhattan, they would still have several hundred million dollars left over. That is the power of compound interest over time.

Listing some popular websites from Stock Market websites and other financial institutions.

Create a virtual stock market game or a stock market contest on How The Market Works.

Real-life and virtual trading hours for our site (all times Eastern).

Note: Stock Market trading is Monday-Friday, except on holidays.

An investor’s instructions to a broker or brokerage firm to purchase or sell a security. Orders are typically placed over the phone or online. Orders fall into different available types which allow investors to place restrictions on their orders affecting the price and time at which the order can be executed.

Day traders buy and sell the same stock (or other investment type) within a single trading day.

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments, with the intention of subsequently repurchasing them (“covering”) at a lower price. In the event of an interim price decline, the short seller will profit, since the cost of repurchase will be less than the proceeds received upon the initial (short) sale. Conversely, the short seller will incur a loss in the event that the price of a shorted instrument should rise prior to repurchase.

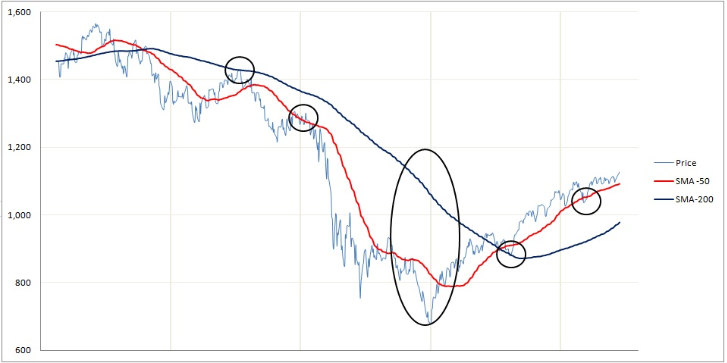

Moving Averages Moving Averages are one of the most popular and important technical analysis tools. The ease of use and simple calculation make it a great tool to get information quickly. They also provide the basics for more advanced technical analysis tools like MACD and Bollinger Bands and can be useful for removing some of Read More…