The beginning of the week was dominated by the Chinese currency devaluation; the Chinese central bank devalued the Yuan by over 4% from Monday’s exchange rate with the US dollar over the week. However, by this morning, things have returned more-or-less to “normal” on international currency markets.

The biggest fear when the devaluation was announced was the possibility of a “currency war”; where countries try to repeatedly de-value their currencies against each other to help boost exports their own exports. One of the immediate results from a threat of a currency war is that investors try to “flee” volatile assets like stocks to “haven” securities like bonds and gold. This makes the demand for stocks fall (and so stock prices tend to do down), while the demand for gold and bonds goes up (and the prices with it).

Thursday saw calmer markets as fewer investors were fearing a currency war; bond and gold prices dropped back to previous levels and stock prices also began their recovery.

Read More on Bloomberg

Rounding Bottom

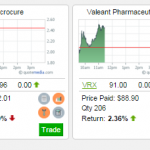

Rounding Bottom Huge update for your Open Positions!

Huge update for your Open Positions!