COMPLETE DEFINITION: Technical analysis evolved from analyzing 100s of years of stock data. The theories for technical analysis began in Joseph de la Vega’s accounts of the Dutch markets in the 17th century. In the 1920s and 1930s Richard W. Schabacker wrote books continuing the work of Charles Dow and William Peter Hamilton from their books Stock Market Theory and Practice and Technical Market Analysis. In 1948 Robert D. Edwards and John Magee published Technical Analysis of Stock Trends. This book is considered to be the break through works of the discipline.

Technical Analysis dates back hundreds of years ago. According to historical records, a great Japanese rice trader by the name of Homma Munehisa (1724-1803) fathered candlestick charting and at today’s value, would have made over $100 billion in profits. He was considered the greatest trader in the history of the financial markets. This type of charting will be covered in subsequent articles (candlestick charting will be used in all articles). Therefore, technical analysis emerged from Japan. In the U.S., technical analysis first started to gain some following due to Charles Dow’s Dow Theory in the late 19th century. Charles Dow formed 6 principles that formed the foundation of technical analysis:

- Three-moving Parts – The market has a primary movement, a secondary reaction, and a minor swing movement. The primary movement is the long-term trend that lasts for years, the secondary reaction is the retrace from the primary movement (typically lasting for months), and the minor swings are the much shorter swings that occur within a chart (usually neutral and lasting from hours up to a month).

- Three-Phase Trends – The market is composed of three phases: an accumulation phase, public/media phase, and a distribution/selling phase. The “smart money” (sophisticated professionals) as the ones who are purchasing shares in Phase 1. In Phase 2, the media starts to focus on the particular stock or sector and the public (retail traders/investors) jump in. These are the momentum traders/investors that see a trend forming and want to get in on the action. In Phase 3, the “smart money” actually sells while the retail traders/investors keep buying.

- Discounting Mechanism – The market discounts all news. This means that news that comes out is already factored in, or “priced” in. Obviously, this does not include illegal inside information.

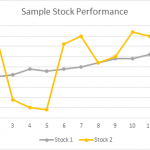

- Major Average Confirmation – This means that one industry that is dependent on another cannot rally unless both are rallying. This is especially true if the entire market is rallying but several key sectors are declining. In the chart below, you can see that the homebuilders (orange line) declined long before the market declined. The banking sector (sky blue) declined soon after. The financial sector used to be the #1 sector in terms of capitalization (banks were doing very well at the time!). Real estate and its related industries account for at least 25% of the U.S.’s GDP. With these two major powerhouse sectors declining, the market didn’t stand a chance.

- Volume Confirms Action – Volume is extremely important. For a trend to continue, volume must increase. This represents added interest and additional buying which is required for a trend to propel itself to new highs. If a rally continues on lower volume, the trend cannot sustain itself and will fail. Let’s take a look at the rallies we had in 2008 as an example. Notice how the rallies were made on low volume and on the declines, we saw increasing volume. A healthy, strong market would exhibit the complete opposite.

- Trends Continue Until They End – This is self-explanatory. An up trend continues until it ends and a downtrend continues until it ends. Typically, a trend ends when a lower high (for an up trend) or a higher low (for a downtrend) is achieved.

Now that we covered the basic history and foundation of technical analysis, let’s move on to its purposes and uses. It’s not designed to be a crystal ball! Patterns can and will fail and you will occasionally take losses. However, if you focus on highly reliable patterns, combine indicators, and perfect your entry and exit points, you’ll be way ahead of the game.

- Entry & Exit Points – Technical analysis gives traders and investors advanced warning of when a trend changes against their favor. If you know how to recognize certain chart patterns and use price-volume divergences to your advantage, you’ll join the ranks of the “smart money” that accumulate long before everyone else jumps in. You’ll also be able to identify reversals, sometimes on the very same day and know when to exit a position.

- Low-Risk Trading – The chances of putting on a successful trade is greater if you use technical analysis.

- Know When to Sell Short – Technical analysis is not only used for “going long” (buying stock). 9 out of 10 investors/traders do not know how to sell stocks short, or are afraid to do so.

- Use Candles to “Light the Path” – Candlestick charting, will help you see warnings in advance and give you enough time to react.

- Identify and Trade Gaps and News – There are four main types of gaps: area, continuation, breakaway, and exhaustion gaps. Can you tell the difference? Gaps are usually formed on news, such as earnings or FDA approvals, etc.

- Identify Potential Support & Resistance Areas – Trend lines are a part of basic chart reading.

- Combine Indicators to Support Trading Decisions – There are dozens of indicators that are available to make trading decisions. You may have heard of the MACD, RSI, Stochastics, Money Flow, and many others. Or, perhaps you didn’t.

Why Use Options

Why Use Options Sharpe Ratio (Beginner)

Sharpe Ratio (Beginner)