Definition “Asset Allocation” is how you have divided up your investments across different assets. You can have all your assets in one place, or you can use diversification to spread them around to reduce risk. Details Whenever you pick stocks, open a bank account, get paid, buy something, or do anything with any resources, you Read More…

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. Here we will look at the larger overall strategies rather than very specific strategies. Given Read More…

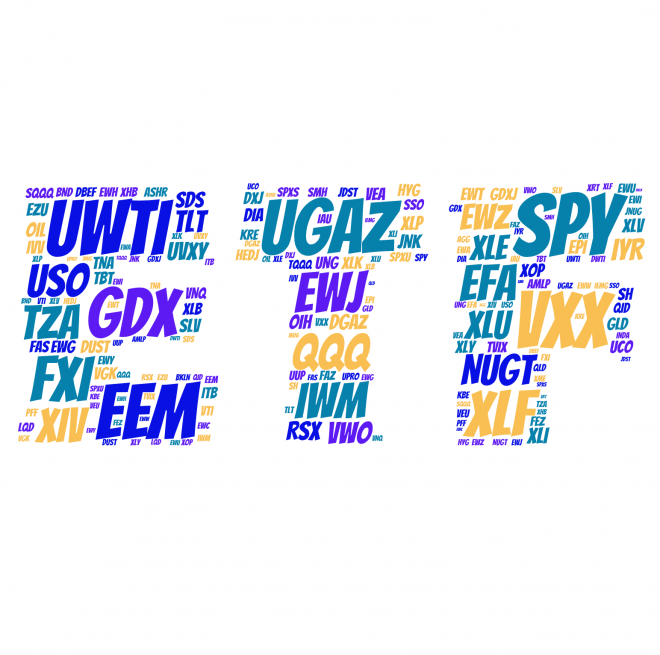

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indecies (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions. However, using financial derivatives and debt, there are also “Leveraged ETFs”, Read More…

ETFs with best rate of return for one and three years

The S&P 500, or the Standard & Poor’s 500, is a stock market index based on the common stock prices of 500 top publicly traded American companies, as determined by S&P. It differs from other stock market indices like the Dow Jones Industrial Average and the Nasdaq Composite because it tracks a different number of stocks and weights the stocks differently. It is one of the most commonly followed indices and many consider it the best representation of the market and a bellwether for the U.S. economy.

Most Popular Canadian Stocks Looking to trade Canadian stocks in your HowTheMarketWorks portfolio, but not sure where to look? You can find a list of the most popular Canadian companies, their symbol, and quotes here! SYMBOL COMPANY NAME Quote And Chart Trade It On HTMW RY Royal Bank of Canada Get Quote! Buy It On Read More…

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running start. Establish Goals Before choosing Read More…

Introduction The Sharpe Ratio is an important tool for evaluating a stock, or a portfolio, based on how risky it is to get a higher return. You can use the Sharpe Ratio to determine how consistent the returns of a stock or portfolio are, so you can determine if the returns are stemming more from Read More…

Over-The-Counter (OTC) Stocks Most investors are familiar with NASDAQ, the NYSE (New York Stock Exchange), TSX (Toronto Stock Exchange), and most other large national stock exchanges. However, there are also thousands of companies that want to sell shares to the general public, but are not able to sell on these exchanges. Stock traded on these Read More…

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

We will teach you how to save money so that you can afford your future now. There are two main questions you need to ask yourself to effective save money: A.“How much will I need?”, and B.“What can I afford?”

A portfolio is a collection of assets that contribute collectively to an overall return. There are many different reasons you could create a portfolio, and you need to define your reason or objective from the very beginning before adding stocks and other securities to your account.

HTMW QuoteIt can be argued that the decision to follow a strategy – any strategy – is more important than the decision about what specific strategy to pick. Even a mediocre strategy… can be more profitable than the investing done by someone without a strategy at all

. . . John Reese

Direxion Small Cap Bear3X – Triple-Leveraged ETF is an index fund ETF (Exchange Traded Fund) designed to seek a daily result of 300% of the INVERSE of the performance of the Russell 2000 Small Cap Index.

The most basic skill needed for investing is the ability to read a stock chart and then understand how that data can aid your investing success. One of the biggest mistakes of today’s investors is overlooking this basic skill and shooting from the hip. This article explains the importance of candlesticks which are the smallest building block of stock charts.

Opening a Brokerage Account is Easier Than you Think Be Ready for the next 5% pullback in the stock market and open your real brokerage account today! Given that most market analysts are predicting a pullback of 5% or more from the recent market highs in the coming days, now may be the best time Read More…

Your ideal investment or investment portfolio gives you the most opportunity for the risk you can bear. In this sense, it is important to understand the risk inherent in an investment before you look for the opportunity.