Simply put, when you have money to invest for an extended period of time (like 20 years or more), the stock market historically has provided the greatest return.

When most people are able to save money, they usually put it in the bank. Banks usually pay interest on the cash in your account, so if you have $1000 in your savings account and the bank pays you 3% interest then at the end of a year you will have about $1030. Once the savings balance gets bigger, a lot of people hope to earn more than what the bank is paying in interest, so they invest in real estate, stocks, bonds, and/or gold.

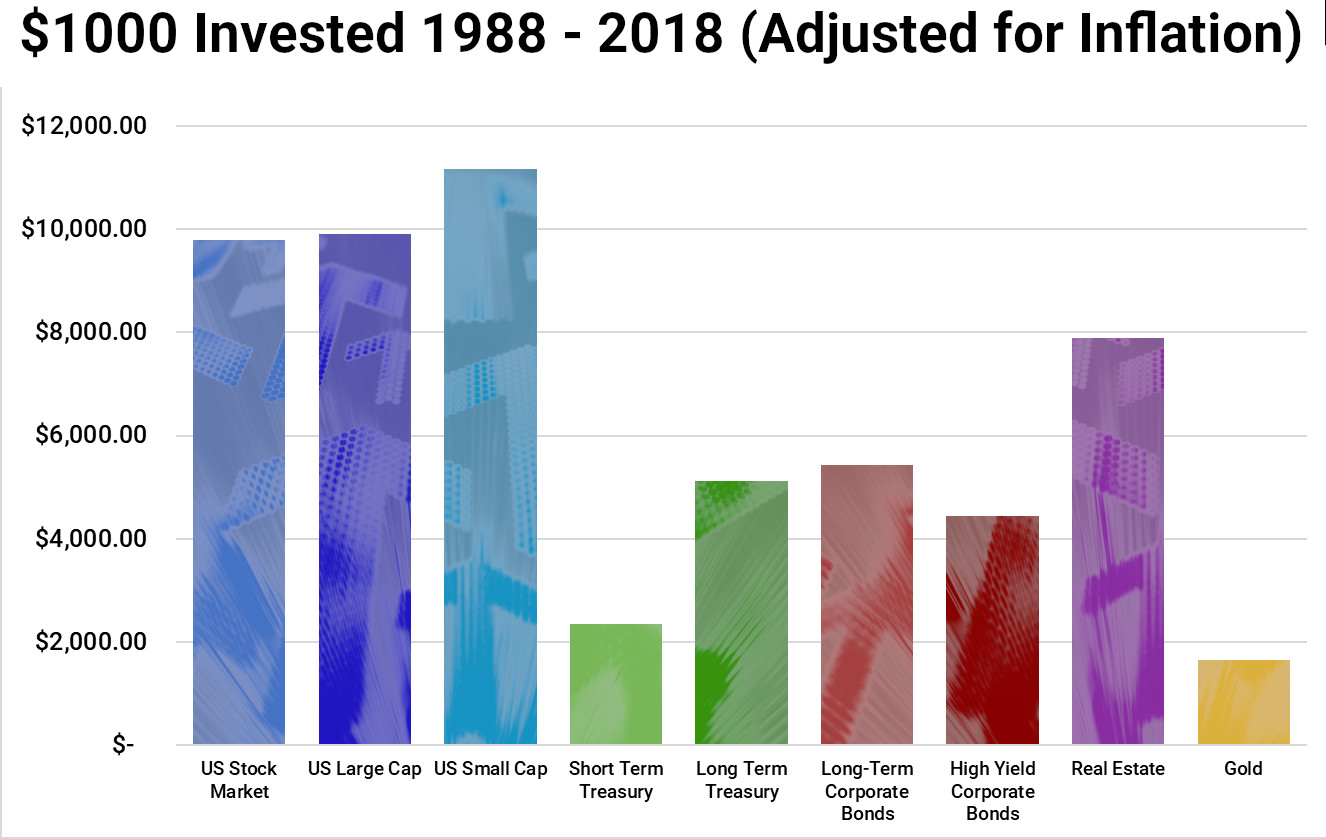

Historical Returns of Investments

While no one knows for sure what will happen in the future, a look at historical returns shows how these different investments have performed over time.

Here’s a chart of average percentage returns for the 30 year period from 1988 to 2018:

From this chart we see that the stock market has performed the best – between a 9-fold and 11-fold increase, depending on the security types. Gold performed the worst – one major reason being that gold tends to go up in price during years where there is low inflation, and down in years with high inflation.

So what does that mean? Over time there is a HUGE difference between 10% and 2%. Here is another way to look at it–this chart shows the growth of $100 for the 46 years from 1972 to 2018.

So, would you rather have $401 or $1,612! That’s a big difference for just $100. For $10,000 the results would be exactly 100x or $40,100 versus $161,200.

Finally, this chart looks at average returns from 198 through 2018 and shows that the S&P 500 stocks were the best return, with a 12% average annual return – beating out both the large-cap stocks in the Dow Jones Industrial Average and the Small-Cap stocks in the Russell 2000 index.

In this table you also need to note the Standard Deviation column which measures the variance or volatility of the returns. It shows that Small Stocks also have the highest variance. This is why we say “over time” that stocks have the highest returns. If you looked at just one year or even five years, you might not see the same results because stocks are so volatile, but the longer the time period you have to keep the money invested the better it is to invest in stocks.

Summary

Simply put, if you want to maximize your personal net worth, if you want to be “rich”, if you want to be a “millionaire”, if you want to retire early–you must start saving and investing TODAY.

The earlier you get started, the more time your money has to grow. And the more time it has to grow, the bigger it will become.

Understanding how the stock market works and how to invest is so important because it determines how much your net worth will be when you retire. Are you going to leave your cash in your savings account at the bank all your life and earn an average of 3%? Or are you going to invest it in the stock market and try to earn 11%?

How To Invest in the Stock Market

The best way to learn anything is to practice. Use this virtual trading site to learn to invest and experiment with trading strategies. Don’t worry if you make mistakes–better to lose our fake money then your real money later.

You can use www.StockBrokers.com to compare special offers, commission rates, and other services of more online brokerages to find the perfect one for you. (Don’t worry, you can click www.StockBrokers.com and it will open a new tab so you won’t lose your place in this course.)

Investing in Latvia

Investing in Latvia Collar Option Strategy

Collar Option Strategy